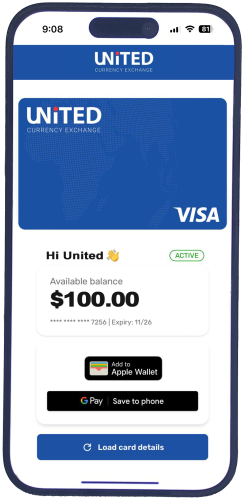

United Currency Exchange

Travel Prepaid Card

– VISA Wholesale Interbank FX Rates

– No Foreign Currency Conversion Fee

– No International Transaction Fee

– Access to over 150 Foreign Currencies & Accepted Worldwide

Check our Currency Exchange Rates to see how much you save.